Separation Certificate Form

What is the Employment Separation Certificate Used For?

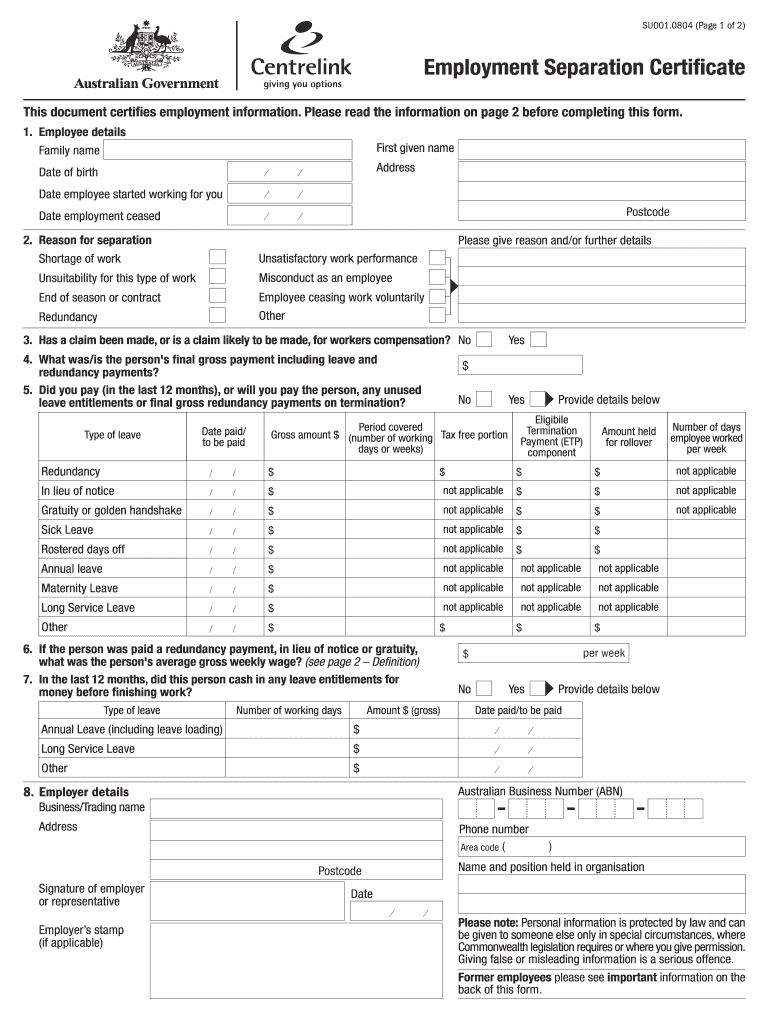

The Australian government requires an Employment Separation Certificate to be issued by an employer at the request of an ex-employee or the Department of Human Services for further potential social security payments.

The employee can ask for this document in case of dismissal from the workplace due to redundancy, a transfer, quitting a position voluntarily or other reasons. It should be provided as soon as possible, but no later than 14 days after the request.

As a Commonwealth Government form, the Separation Certificate is issued not only after employment ceases. It can also be issued when there is a decrease in working hours or if an employee makes a shift from full-time work to casual.

This report displays basic information about the worker: how long he or she has worked in a position, the reason for dismissal and the final amount of payment. Information concerning further redundancy pay or leave entitlements is also included.

How to Fill out the Separation Certificate for Employers: Detailed Instructions

Use these advantages to prepare the form online with the airSlate SignNow:

- All the answer boxes are highlighted blue for your convenience.

- It’s easy to complete the template using either your desktop or mobile device.

- Navigate through the document attentively: go through each field by ticking it, using the yellow arrow or by hitting the Tab key on your keyboard.

- Fill in the boxes of the employment separation certificate as completely as possible. You should give further explanatory details if the reason for disengagement is unsatisfactory work performance or misconduct as an employee.

- Create and sign the document in seconds using airSlate SignNow's eSignature.

- You can easily attach the employer’s stamp by uploading it from your device. It takes only a few steps.

- Forward the completed form to the requestor or save it for future use.

Keep in mind that giving false or misleading information is a serious offense. Be sure to check your template twice before submitting.

Quick guide on how to complete employment separation certificate form

A concise manual on how to prepare your employment separation certificate china

Locating the appropriate template can be daunting when you need to submit official international paperwork. Even if you have the necessary document, it can be cumbersome to swiftly prepare it according to all the stipulations if you utilize printed versions instead of handling everything digitally. airSlate SignNow is the online e-signature platform that assists you in navigating these challenges. It enables you to select your su001 0804 and effortlessly complete and sign it on the spot without needing to reprint documents if you make an error.

Here are the actions you should take to prepare your employment separation certificate using airSlate SignNow:

- Click the Obtain Form button to instantly upload your document to our editor.

- Begin with the first vacant field, enter your information, and proceed with the Next tool.

- Complete the empty fields with the X and Checkmark tools available in the panel above.

- Choose the Highlight or Line options to emphasize the most crucial details.

- Select Image and upload one if your separation certificate requires it.

- Utilize the right-hand pane to add additional fields for you or others to complete as needed.

- Review your entries and confirm the document by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing process by clicking the Finished button and choosing your file-sharing preferences.

Once your employee separation certificate is prepared, you can distribute it in your preferred manner - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized into folders according to your preferences. Don’t spend time on manual form filling; choose airSlate SignNow!

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Separation Certificate Form

Instructions and help about Separation Certificate

FAQs

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

Related searches to Separation Certificate

Create this form in 5 minutes!

How to create an eSignature for the employment separation certificate form

How to create an electronic signature for the Employment Separation Certificate Form in the online mode

How to make an eSignature for your Employment Separation Certificate Form in Chrome

How to create an electronic signature for signing the Employment Separation Certificate Form in Gmail

How to make an eSignature for the Employment Separation Certificate Form straight from your smartphone

How to create an eSignature for the Employment Separation Certificate Form on iOS devices

How to generate an electronic signature for the Employment Separation Certificate Form on Android

People also ask

-

What is an employment separation certificate china?

An employment separation certificate china is a formal document provided by employers to confirm the end of employment for an employee. It outlines key details such as the duration of employment and the reason for separation, helping employees in their job search. This certificate is essential for individuals applying for new positions or government benefits.

-

How do I obtain an employment separation certificate china using airSlate SignNow?

To obtain an employment separation certificate china with airSlate SignNow, simply create the document using our easy-to-use templates. You can personalize the certificate with necessary details and send it for eSignature to ensure its authenticity. Our platform streamlines the process, allowing quick and efficient document handling.

-

What are the benefits of using airSlate SignNow for my employment separation certificate china?

Using airSlate SignNow for your employment separation certificate china enhances efficiency and compliance. The platform allows for quick eSigning, reducing paperwork and time delays involved in traditional methods. Additionally, our solution provides security measures to ensure your documents are protected.

-

Are there any costs associated with acquiring an employment separation certificate china through airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs. The cost for acquiring and eSigning an employment separation certificate china is typically cost-effective, providing value for teams that require frequent document management. You can choose a plan that suits your budget for effective use.

-

Can I customize my employment separation certificate china on airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your employment separation certificate china by adding your company logo, specific employee details, and adjusting the wording as needed. This flexibility ensures that your certificates meet legal standards and reflect your company’s branding.

-

Is it possible to integrate airSlate SignNow with other tools for managing employment separation certificates china?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and other document management systems. This allows for streamlined workflows when managing your employment separation certificates china alongside other business documents. Effortlessly share and access your files across different applications.

-

What makes airSlate SignNow secure for handling employment separation certificates china?

airSlate SignNow utilizes advanced encryption and security protocols to ensure that your employment separation certificates china are secure. We comply with industry standards to protect your sensitive data and documents during the signing process. Our platform also features secure access controls to manage who can view and sign documents.

Get more for Separation Certificate

- Sweet home healthcare timesheets form

- Alabama drivers license template form

- Wells fargo mortgage assistance application fha wells fargo mortgage assistance application fha form

- Life care planning kaiser permanente mydoctor kaiserpermanente form

- Application for lewis mcchord communities wwwjblmc form

- Indiana university plagiarism test certificate answers form

- Tokyo gardens catering llc tgcsushicom form

- Application for employment rhapsodielle form

Find out other Separation Certificate

- How To Sign West Virginia Plumbing PPT

- How Do I Sign West Virginia Plumbing PPT

- Can I Sign West Virginia Plumbing PPT

- Help Me With Sign West Virginia Plumbing PPT

- Help Me With Sign West Virginia Plumbing PPT

- How Can I Sign West Virginia Plumbing PPT

- Can I Sign West Virginia Plumbing PPT

- How Can I Sign West Virginia Plumbing PPT

- How To Sign West Virginia Plumbing PPT

- How Do I Sign West Virginia Plumbing PPT

- Can I Sign West Virginia Plumbing PPT

- Help Me With Sign West Virginia Plumbing PPT

- How To Sign West Virginia Plumbing PPT

- How Can I Sign West Virginia Plumbing PPT

- Can I Sign West Virginia Plumbing PPT

- How Do I Sign West Virginia Plumbing PPT

- Help Me With Sign West Virginia Plumbing PPT

- How To Sign West Virginia Plumbing PPT

- How Do I Sign West Virginia Plumbing PPT

- How Can I Sign West Virginia Plumbing PPT